What is Stablecoin?

It is a type of cryptocurrency whose value is pegged to an outside asset (currency or commodity), such as the U.S. dollar or gold, in order to minimize price volatility.

With stablecoins, a dollar sent is received as a dollar. As a stablecoin user, you can send money across the world and it will retain its value over the transaction. If you wish to use stablecoin, you need to buy it on an exchange and then also buy the same network coin, such as Bitcoin, Ether, Stellar, or Terra, to pay the sending fees in the wallet.

Stablecoins are a lower risk way to get started with earning in DeFi, having relatively high return and rewards to incentive users.

The stablecoin market boomed from $5 billion at the start of 2020, to $28.9 billion at the beginning of 2021, to over $92 billion by May 2021.

According to CoinGgecko, the current total stablecoin market cap is $109,589,622,779 with $110,550,006,387 trading volume. The top five leading stablecoins (ranked by market capitalization) by June 2021 are Tether USD (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and Terra USD(UST).

Types of stablecoin on BSC include:

- Fiat backed stablecoins, such as BUSD, USDC, USDT

- Algo based stablecoins, such as Ampl

- Assets backed stablecoins, such as Venus (VAI), dForce (USDx)

How to receive Stablecoin in MathWallet BSC Wallet?

- Withdraw from other platform:

- Buy stablecoin on crypto exchanges or special aggregate platforms.

- Use DEX platforms to swap stablecoin in a second.

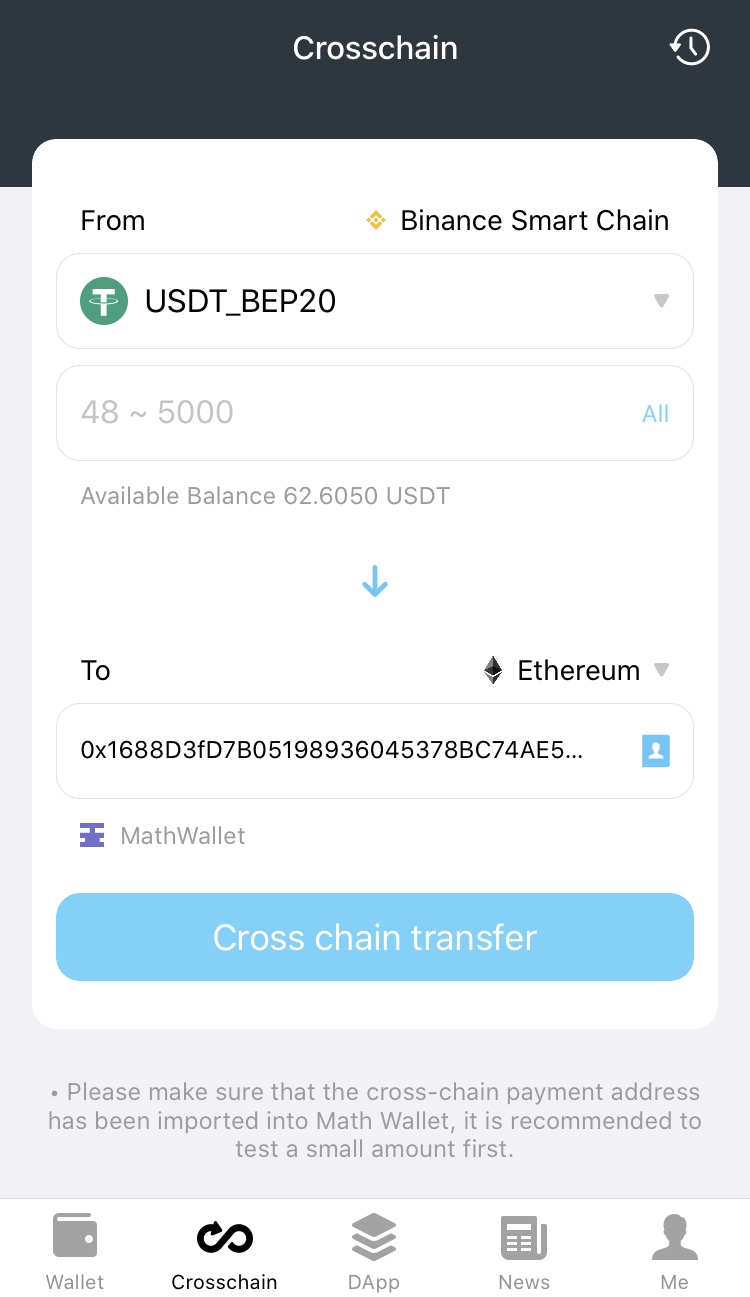

2. Cross-chain transfer from other blockchain into BSC wallet, currently MathWallet supports 7 cross-chain bridge to BSC: ETH, Bitcoin, Binance Chain, Terra, Huobi Eco chain, Polygon, Filecoin.

How to use MathWallet ETH<->BSC cross-chain function for stablecoin?

Please check our step-by-step guide:

Binance Smart Chain cross-chain transfer guide

How to recover ETH/BSC cross-chain transfer?

How to earn stablecoin’s yield on BSC?

There are many ways to earn yield on stablecoin on BSC:

- Single token farming on BSC: Solo, Klend, Autofarm, etc

- LP(liquidity pool) farming with stablecoins: Ellipsis, Belt, Nerve Finance etc

- Lending protocol: Venus, DForce, Cream, ForTube, Alpaca.finance, etc

We will use Nerve Finance as example here:

The Nerve Finance is the first stableswap AMM built on Binance Smart Chain designed to allow trading stablecoins and pegged synthetic assets quickly with minimal slippage and low fees.

The 3Pool of Nerve Finance is BUSD, USDT and USDC, farming steps:

- Deposit BUSD, USDC, or USDT to the liquidity pool

- Receive 3Pool Liquidity Pool (LP) tokens (3NRV-LP). Users can choose to deposit any combination of BUSD, USDC or USDT to this pool in service of receiving 3NRV-LP.

- The fees are returned to pool liquidity providers as well as Nerve token holders. Rewards will be paid out in $NRV — Nerve’s native token.

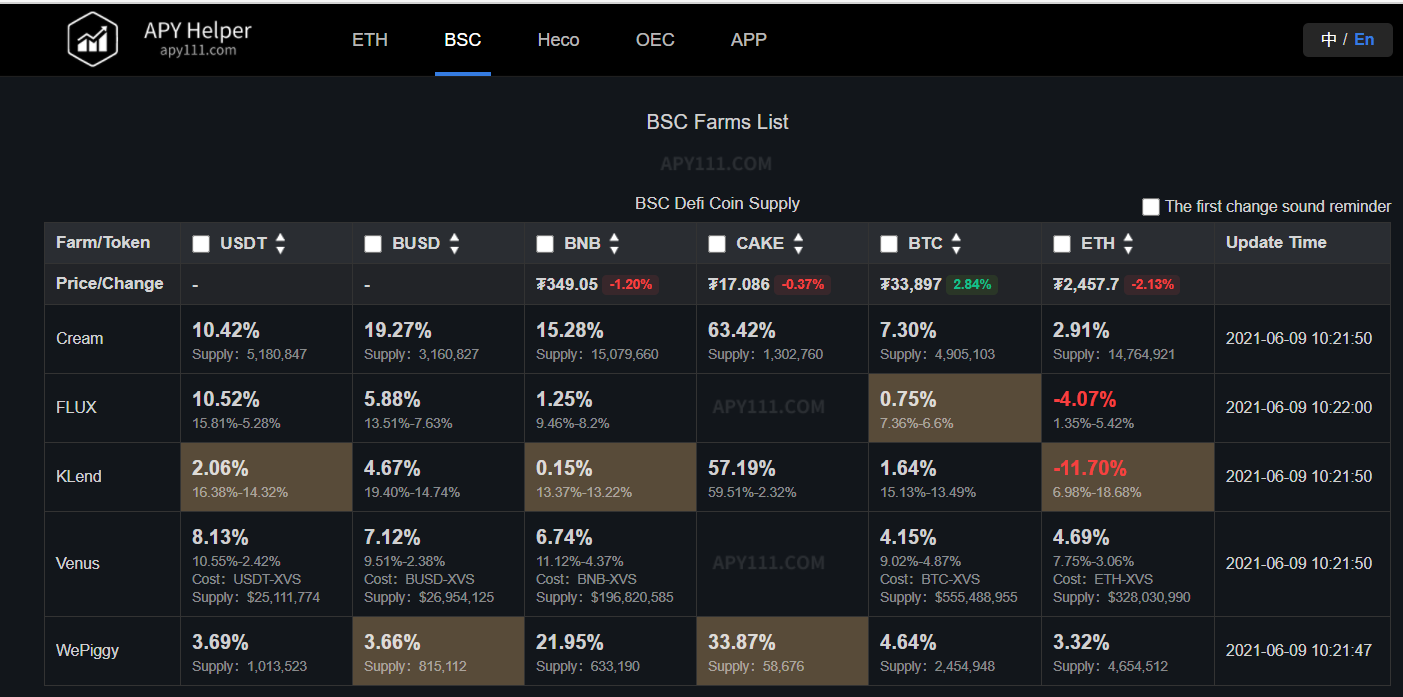

How to find the best yield on BSC stablecoin farming?

APR Helper is a data board that aggregates and displays BSC ecological popular DeFi project token prices and TVL daily change, BSC main assets daily change, popular project single currency and LP farming’ ARY data, and real-time data of BSC Gas. Provide certain data support to DeFi decision-making for the majority of DeFi players.

Reminder: farming has risks and do your research before any investment, farm responsibly.

For all protocols mentioned above, you can access to MathWallet BSC wallet and browse DApp store, to start earning yield on your stablecoin. For more information, please visit mathwallet.org.