BTC biweekly Shark Fin Financing is the latest financial product launched by MathWallet.

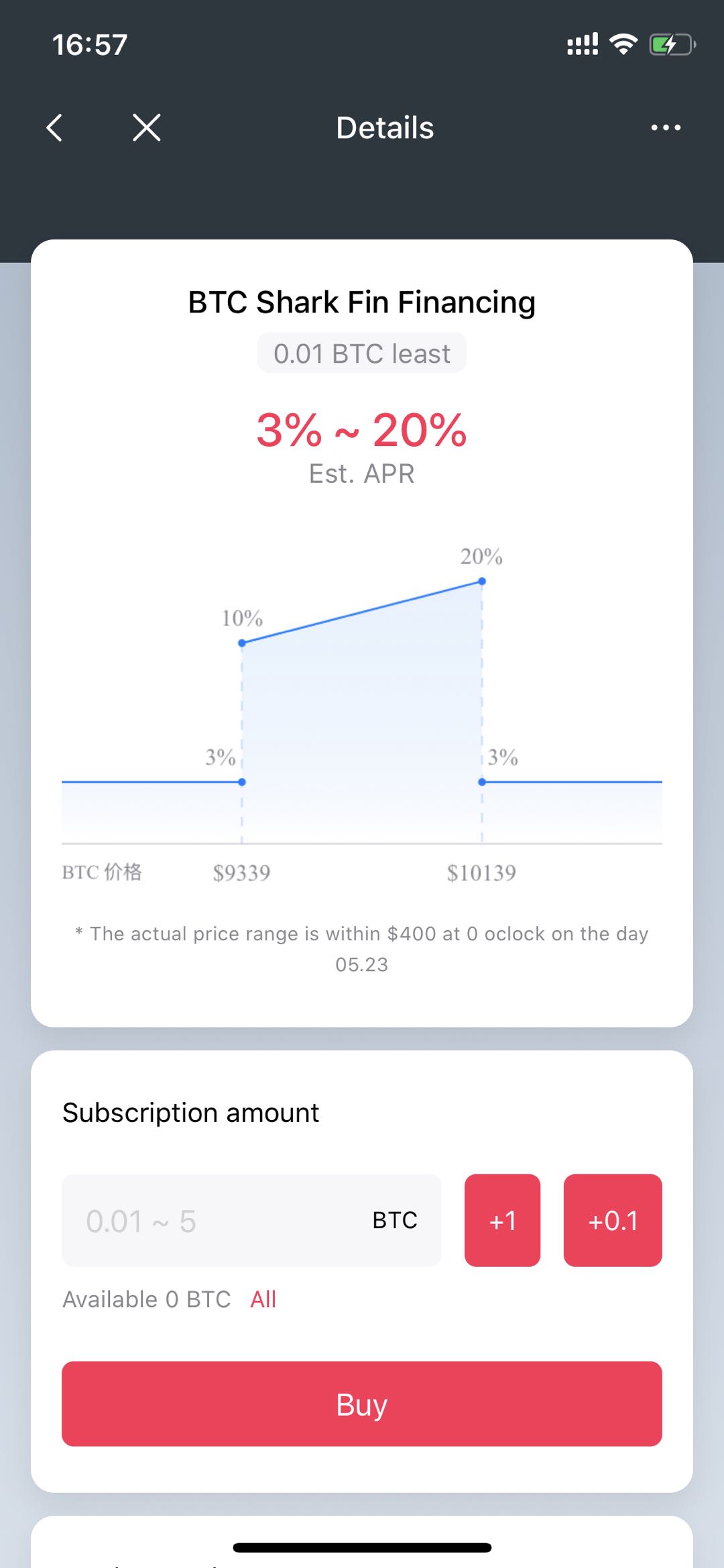

After purchase, users can get an annualized return up to 20% if the price of BTC has been floating in a certain range within the specified period. If the price goes out of the range, user will get a minimum annualized return of 3%.

Open MathWallet – DApps-BTC biweekly Shark Fin Financing

Click to see the details:

Take the BTC biweekly shark fin during this serie as an example:

This product is a fixed term closed product

Subscription period: May 7, 2020 – May 9, 2020 24:00

Product starting date: 00:00, May 10, 2020

Product expiration date: 24:00, May 22, 2020

Fund arrival date: May 23, 2020

The basic concept:

Maturity price: BTCUSD underlying settlement price on the Okex exchange at 16:00 on 5th June, 2020 (UTC + 8)

Observed price: BTCUSD index price on the Okex exchange

Observation period: 0:00, 23rd May, 2020-16:00, 5th June, 2020 (UTC+8)

Investment cases:

Case 1: if the price of BTC during the period ever ≤ 9339 or ≥10193, then the investor will get 3% annualized return at maturity

Case 2: if the price of BTC is always in the range of 9339-10193 during the period, the investor will get an annualized return of 10%-20% at maturity, and the closer the maturity price is to 10193, the higher the investor’s return will be.

Contact us:

Add customer service telegram: /t.me/mathwallet

Email: hello@mathwallet.org

Working Hour:Monday to Friday 10:00 – 19:00